|

|

|

|

History of the stock exchange

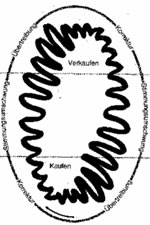

The same theatre piece is ever playing on the stock exchange, boom and bust plays itself out, but by other names.

The memory lingers of the shock of various stock market crashes. The first significant collapse was that of the Grand Parti of 1557. The lending supply was greater than demand.

The next great crash came in Amsterdam, the so-called Tulip Crash. This flower shocked the emerging economy of the otherwise levelheaded country, the Holland of the 17th century. The ambassador of the German Emperor in Turkey brought the Tulip from Turkey to the west. The exotic flower gradually became a symbol of social advancement. Wealthy refined individuals sensed an opportunity and put their money into tulip bulbs. The fatal blow came in 1637, a larger customer had to notice that all three hundred and fifty types were already present on the market in huge quantities. Tulip inflation. Tulip bulbs were suddenly worth no more than any other bulbs.

The midwives to shares were the Amsterdam spice merchants, also called pepper sacks. The largest among them came together to form the “United East India Trading Company“ in 1602. The “V.O.C“ is still known as the mother of joint stock companies of a modern type. The oldest known original share of the V.O.C from the year 1606 hangs today in the Amsterdam stock exchange. On the 9th of November 1843 in Prussia the first regulated stock corporation law and stock exchange with all the elements present came into being. With the exception of banking, joint stock companies could now be founded regardless of economic sector. The midwives to shares were the Amsterdam spice merchants, also called pepper sacks. The largest among them came together to form the “United East India Trading Company“ in 1602. The “V.O.C“ is still known as the mother of joint stock companies of a modern type. The oldest known original share of the V.O.C from the year 1606 hangs today in the Amsterdam stock exchange. On the 9th of November 1843 in Prussia the first regulated stock corporation law and stock exchange with all the elements present came into being. With the exception of banking, joint stock companies could now be founded regardless of economic sector.

The first German joint stock company was brought into being by Elector Friedrich Wilhelm on the 17th of March 1682. It was the „Trading Company on the Coast of Guinea“. The Brandenburg/Africa Company“ which traded in pepper, ivory, gold and slaves on the African coast followed.

The Hapsburgs founded the Eastern Society in 1719, afterwards the various insurance companies of the Hanseatic cities followed. Berlin Assekuranz was founded in Prussia in 1765, the Private Breslau Sugar Refinery in 1770 and in 1793 the Berlin Sugar Boiling Plant.

In the 19th century the stock exchange became a financing instrument for large industrial projects. On the 9th of November 1843 in Prussia the first regulated stock corporation law and stock exchange with all the elements present came into being. With the exception of banking, joint stock companies could now be founded regardless of economic sector.

The term Black Friday comes from the 24th of September 1869 and remembers a day with very heavy stock market losses. The market manipulation of Jay Gould and James Fisk led to a deep fall in the price of Gold that had negative repercussions for shares.

The greatest stock market crash to date happened at the end of October 1929 on Wall Street. Americans who had become affluent wanted to increase their wealth and began to speculate on Margins on the stock exchange. The speculation took on unmanageable proportions and critics saw evil times ahead.

On the morning of the 24th of October 1929 the market began to crumble and a stock market storm was unleashed. Even unshakeable optimists fell into a panic and wanted to turn their shares into cash as quickly as possible. The market fell at a breathtaking rate and led to the depression of the 30s, ending the golden days of the 20s.

On Monday the 19th of October 1987 the Dow Jones recorded the greatest percentage daily loss in its history. It lost 22.6 percent. Computerisation of trading, especially portfolio insurance was held responsible for this dramatic slump in prices.

The last crash for the time being, the bursting of the dot.com bubble, happened in the year 2000.

The last crash for the time being, the bursting of the dot.com bubble, happened in the year 2000.

The world wide triumphal procession of the computer and the World Wide Web was at the end of the 90s a new industrial revolution. The boom in the technology sector, especially in dot.com firms drove prices steeply up and valued start up companies without profits at fantasy prices.

The end was, as ever, tragic. Many companies went bust and the Nasdaq Composite Index lost around 80 percent.

Now in 2007 the old highs of the share indexes have been reached again and even exceeded. The next bust is certainly coming, the only question is when?

|